Have you ever thought about what would happen if you or a loved one got sick or injured and had to pay for expensive medical care? The cost of medical care in India is rising rapidly. A heart attack patient’s hospital stay can cost up to ₹250,000, and a cancer patient’s hospital stay can cost up to ₹500,000. Around 47% of total healthcare expenses are out of pocket in India, and medical inflation is at 14%.

That’s why it’s so important to have health insurance. Health insurance can help to protect you from financial ruin in the event of a serious illness or injury. It can also give you peace of mind knowing that you are prepared for the unexpected.

Let’s explore the reasons why many people are hesitant to buy health insurance and how a newly introduced product aims to address these concerns.

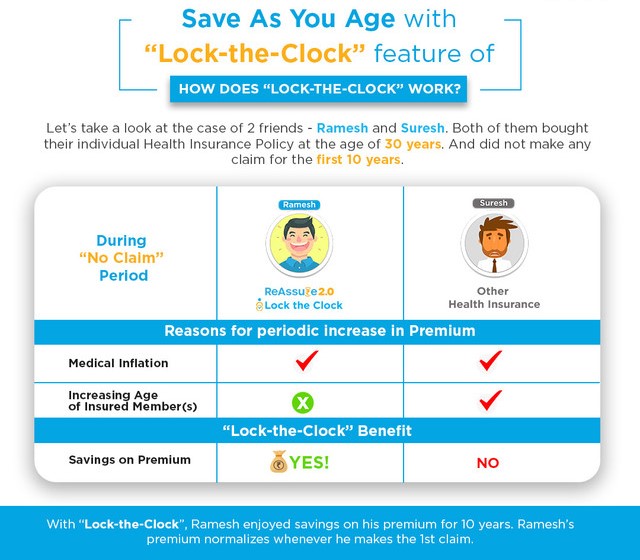

Problem 1. Tired of your health insurance premium increasing every 5 years, even when you don’t make a claim?

One of the primary concerns people have about health insurance is that it does not have a fixed premium like term insurance and instead increases every 5 years. This can be very frustrating, especially when there is no claim made.

For example, let’s say you’re 35 years old and you have a 10 lakh health insurance policy with a yearly premium of Rs. 12,945. Even if you make no claims, your yearly premium will increase to Rs. 13,907 when you’re 40 years old. And it will continue to increase every 5 years after that. This means that by the time you’re 60 years old, you could be paying more than thrice as much for your health insurance premium as you were when you were 35 years old.

But there is a solution to this problem: Lock the Clock medical insurance policy!

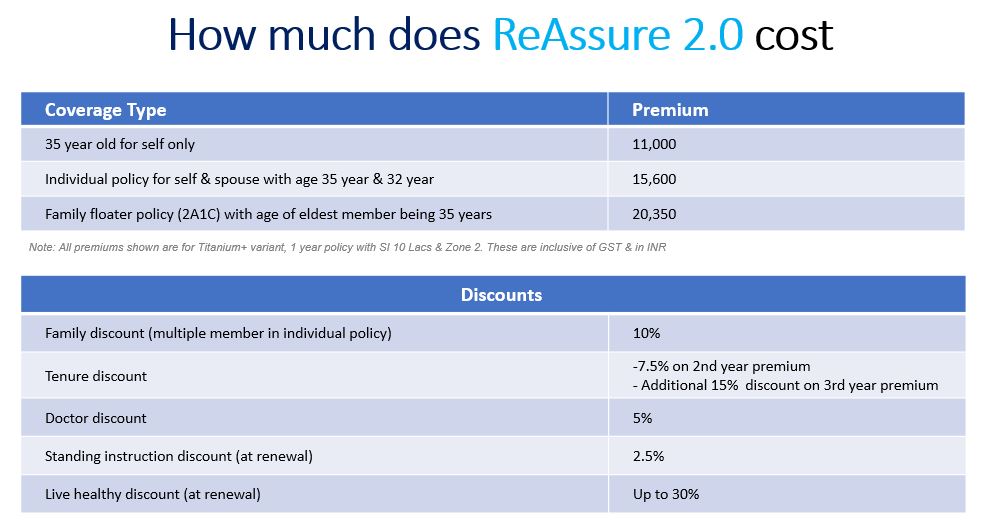

This innovative solution locks your premium, so you pay the same amount every year until you make a claim. For example, let’s say you’re 35 years old and you buy Reassure 2.0 policy with “Lock the Clock” feature with a premium of Rs. 11,000 per year. No matter how many years go by, you’ll always pay Rs. 11,000 per year for your policy, until you make a claim.

Suppose you make your first claim at the age of 58. In this case, you will continue paying the yearly premium of Rs. 11,000 until that age. Only after your first claim, the insurance company will adjust the premium based on the premium charged for individuals aged 55 to 60 years.

“Lock the Clock” is a great way to protect yourself from rising health insurance costs. If you’re looking for a way to lock in your premium and save money, “Lock the Clock” is a great option.

Problem 2. I’m young and healthy and the premium that I pay will go down the drain

When you buy health insurance, you are unlikely to need to make a claim every year. As an incentive to stay healthy, insurance companies offer a No Claim Bonus (NCB). The NCB is a percentage of your coverage amount that is added to your policy each year that you do not make a claim.

For example, if you have a 10 lakh policy with a 20% NCB, your coverage amount will increase to 12 lakhs after the first claim-free year, and to 14 lakhs after the second claim-free year. However, the NCB has its limitations, it typically increases by a fixed percentage each year, and there is a maximum limit, which is typically 50% or 100%.

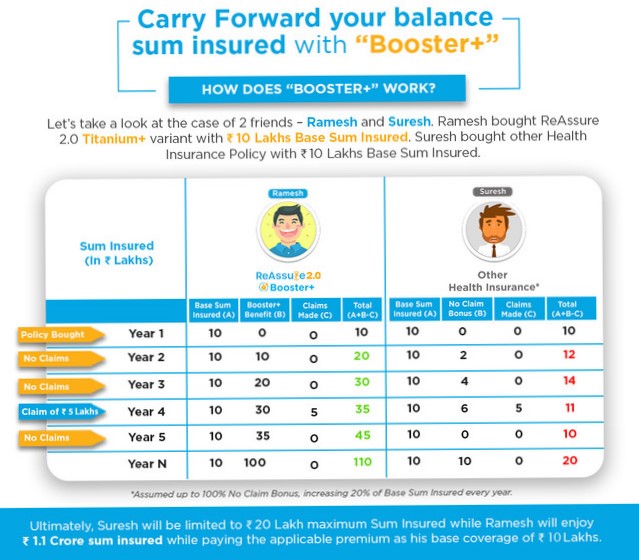

Booster+: Don’t Lose What You Don’t Use

Booster+ is a new health insurance feature that lets you carry forward your unutilized coverage amount up to 10 times. For example, if you buy a policy with a coverage amount of 10 lakhs and don’t make any claims, your coverage will increase to 20 lakhs when it’s time to renew the policy next year. If you still don’t use the coverage, it will increase by another 10 lakhs with each subsequent renewal. A policy with a base sum assured of 10 lakhs can potentially grow to 1 crore through this feature.

What happens if you make a claim?

Even if you make a claim, this policy allows you to carry forward the unused coverage amount to the following year. For example, if you have a 10 lakh policy and make a claim of 3 lakh, you can carry forward the remaining 7 lakh to the following year. This means you will have a total of 17 lakh coverage the following year.

Reassure 2.0 comes in 3 variants

- Bronze+: Carry forward the balance sum insured up to 3 times of base cover.

- Platinum+: Carry forward the balance sum insured up to 5 times of base cover.

- Titanium+: Carry forward the balance sum insured up to 10 times of base cover.

Platinum and Titanium come with the Lock the Clock Feature

Problem 3 – Why Settle for Health Insurance with a 3-4 Year Waiting Period for Pre-existing Diseases?

India is the diabetes capital of the world, with over 100 million people living with the condition. Other chronic diseases like hypertension are also widespread. Unfortunately, many insurance companies impose a waiting period of 3-4 years before covering pre-existing conditions. This can make it difficult for people with these conditions to afford the high cost of healthcare.

Are you tired of waiting for coverage for your pre-existing conditions?

With Niva Bupa’s Disease Management add-on, you can get coverage for conditions like diabetes and hypertension from Day 1, without any waiting period. This means you can get the treatment you need without having to wait months or even years. The Disease management feature is a great way to get the coverage you need for your pre-existing condition.

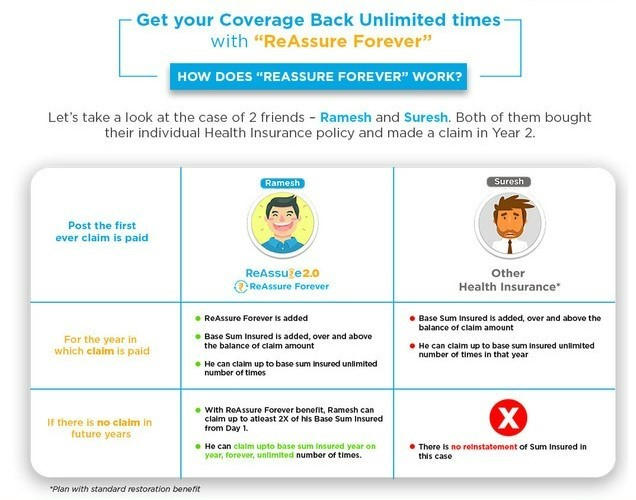

Problem 4 – What Happens After Exhausting Your Health Insurance Sum Insured?

Imagine you are hospitalized and your health insurance policy has a sum insured of 10 lakhs. After your treatment, you have exhausted your coverage for the year. You are now concerned about potential medical needs that could arise in the future.

But what if there was a way to prevent this dilemma? The Reassure+ Benefit, is a feature that ensures your coverage is effortlessly restored.

The benefit reinstates your health insurance coverage after you have made a claim. This means that you can start fresh with a new coverage limit, even if you have already made a claim.

For example, let’s say you have a 10 lakh policy and make a claim of 4 lakhs. Typically, you would be left with a coverage of 6 lakhs. However, with the Reassure+ Benefit, your complete base coverage of 10 lakhs is reinstated. This means that you have a total coverage of 16 lakhs, giving you peace of mind for any future medical needs.

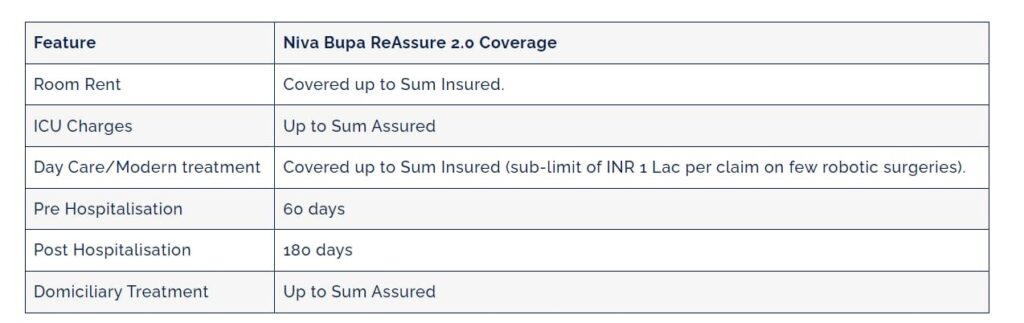

Problem 5 – Room-rent limits can leave patients with high out-of-pocket costs and less choice when hospitalized

Health insurance policies often have room-rent limits and restrictions on higher-category rooms. This means that the insurance company may not cover the full cost of your room, and you may have to pay out of pocket for the difference. For example, if your policy has a room-rent limit of ₹4000 per day and you stay in a room that costs ₹5000 per day, you would have to pay ₹1000 out of pocket.

Some policies also only cover certain rooms, such as private AC rooms. If a private AC room is not available, you may have to choose a more expensive room, such as a deluxe or suite room. In such cases, you would have to pay the additional cost. In addition to room rent, other expenses such as treatment, doctor’s fees, and miscellaneous charges may also be higher if you choose a higher-category room. This is because hospitals have different rate cards for different room categories. For example, a service that costs ₹1000 for a patient in a private AC room could cost ₹2000 for a patient in a Deluxe room.

However, there are now health insurance policies that eliminate room rent limits. Reassure 2.0 is one such policy. This means you can choose any room you want, without worrying about the cost. It will cover you, no matter what room you choose. So don’t let room rent limits prevent you from getting the care you need.

Problem 6 – Budget Constraints: Buying a Policy will Make us Bleed Financially 🙂

When it comes to considering health insurance, we often hear the familiar refrain, “I understand its importance, but I can’t afford it right now. I don’t have 20,000 to 25,000 rupees for a health plan.” However, the real question is, if you lack the means to invest in a health plan, where will you find 3-4 lakhs to cover medical expenses in the event of hospitalization?

Many people believe that health insurance is too expensive and that they cannot afford it. This misconception can deter people from obtaining health insurance, which can leave them vulnerable to financial ruin in the event of a medical emergency.

However, health insurance can be surprisingly affordable. For example, a 35-year-old individual and their 32-year-old spouse could pay as little as Rs. 23,300 per year for Reassure 2.0. This is a very affordable price for peace of mind knowing that you are covered in the event of a medical emergency.

Are you looking for a comprehensive health insurance plan that offers peace of mind and financial security? If so, Niva Bupa Reassure 2.0 is a very good option. With features like Lock the Clock, carry-forward of unutilized coverage, coverage for pre-existing illnesses from day one, no room rent limits, and consistent premium payments, Niva Bupa Reassure 2.0 ensures that you are well covered in case of an unexpected medical emergency.