Imagine you have a lottery ticket. You’re not sure if it’s a winner, but you’re hopeful. Then, someone offers to trade you their ticket for a gourmet chocolate truffle. You know that their ticket has the same chance of winning as yours, but you hesitate. What if your ticket is the winner and you trade it away for a chocolate truffle?

In a psychology experiment, 61 people were given this exact choice. 80% of the participants believed that every ticket had the same chance of winning. Even among those who knew that their ticket had equal odds, 60% refused to trade for the truffle.

What makes people act so irrationally? The answer lies in a psychological quirk known as “loss aversion.”

Loss Aversion in Real Investments

The lottery ticket experiment is a good example of loss aversion. Even though the participants knew that their ticket had the same chance of winning as anyone else’s, many of them refused to trade it away, even for a gourmet chocolate truffle. This is because they couldn’t bear the thought of trading away their ticket and then having the original ticket win.

This is a dilemma that many people face when it comes to investing. We often hold on to investments that we wouldn’t invest in today, even when we know that they’re not in our best interest.

Examples of Loss Aversion in Investing

LIC Policies: LIC traditional policies are a popular choice in India, but many policyholders realize over time that the returns are low and the life coverage is inadequate. These policies typically have a premium-paying term of around 15 to 20 years, so after a few years, many policyholders realize that they made a mistake by investing in these plans.

Loss aversion comes into play when policyholders are hesitant to surrender their LIC policies, even though they know that they are not a good investment. This is because surrendering the policy means realizing a financial loss, as the payout would be less than the premiums paid.

For instance, a friend of mine has paid yearly premiums of around ₹80,000 for 5 years, totalling ₹400,000. If he surrenders the policy now, he will only get back around ₹2,15,000. It’s a a difficult choice, as he must decide whether to accept the loss or continue with an investment that no longer aligns with his financial goals.

The Stock Market: The stock market is another area where loss aversion can lead to bad investment decisions. For example, you bought a stock for ₹100 and it is now trading at ₹50. You are hesitant to sell the stock because you don’t want to realize a loss of ₹50.

However, it is important to remember that the past is the past. You cannot control what has already happened.

Instead of focusing on the loss you have already incurred, you should focus on the future. If you would not buy the stock at ₹50 today, then you should sell it. By selling the investment, you can free up your money to invest in something else that is more likely to give you a return.

Why do we hold on to bad investments?

- Fear of loss: As we saw in the lottery ticket experiment, we are afraid of losing something that we already have, even if it’s not worth much. This is because we feel the pain of loss more intensely than the pleasure of an equal gain.

- Hope for a turnaround: We may hold on to an investment, hoping it will eventually become profitable again.

- Emotional attachment: People become emotionally attached to their investments, making it hard to let go.

- Anchoring. We get attached to the price we paid for an investment and are reluctant to sell it for less, even if the market value has changed.

How to overcome loss aversion in investing

There are a few things that you can do to overcome loss aversion in investing:

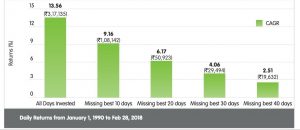

- Set kill criteria for your investments. This means deciding in advance at what point you will sell an investment, regardless of whether you are making a profit or a loss. This will help you to avoid holding on to bad investments for too long.

- Reframe your investment decisions. Instead of thinking about whether you are making a profit or a loss, think about whether you would invest in the same thing today. If you wouldn’t, then it’s time to sell.

Investing is similar to driving down a highway. When we see a sign that says “Road Closed Ahead,” we can either keep driving forward, hoping that the road will open up again soon, or we can take an exit ramp and detour around the closed road.

If we keep driving forward, we are taking a risk that the road will remain closed and we will have to turn around and drive back. This is like holding on to a bad investment because of loss aversion. We are taking a risk that the investment will not recover, and we may end up losing even more money.

The better option is to take an exit ramp and sell the bad investment. This may mean realizing a loss, but it is a safer option in the long run. By overcoming loss aversion and making sound investment decisions, we can avoid the pitfalls of loss aversion and achieve our financial goals.

What tips would you give to investors who are struggling to overcome loss aversion?