Most of us have a tendency to wait until the last moment to start making tax saving investments, and more often than not, we end up making the wrong decision.

The key here is to begin investing at the start of the financial year and change the notion of tax saving into tax planning creating a strategy to help you maximise your tax savings together with wealth creation.

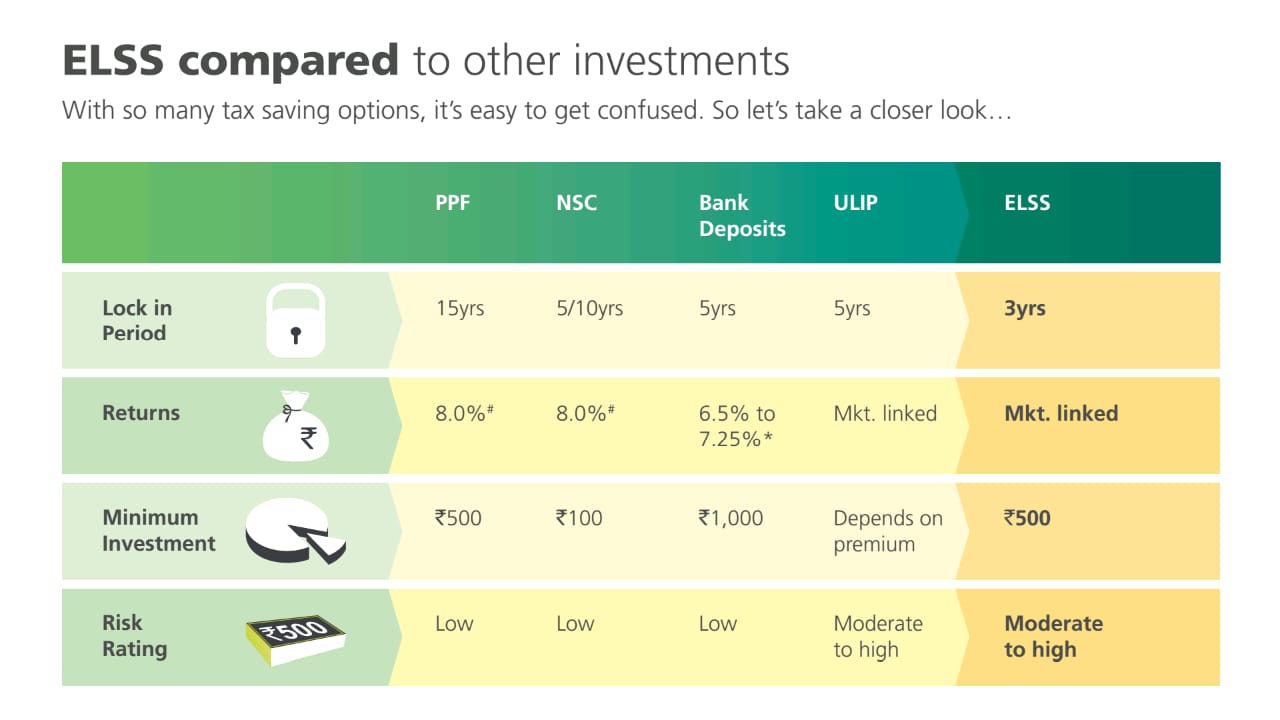

But with so many options, how does one choose the right one? There is no single answer. And that is simply because everyone’s goals are different and so are their risk appetites. However what’s important is to keep in mind that such investments are not just to save tax, but also to build wealth and beat inflation over the long term!

Equity linked savings scheme (ELSS) is one such avenue that provides both tax saving benefits and a relatively higher growth potential over time.

Save upto Rs. 46,800 in tax and lock in period of only 3 years