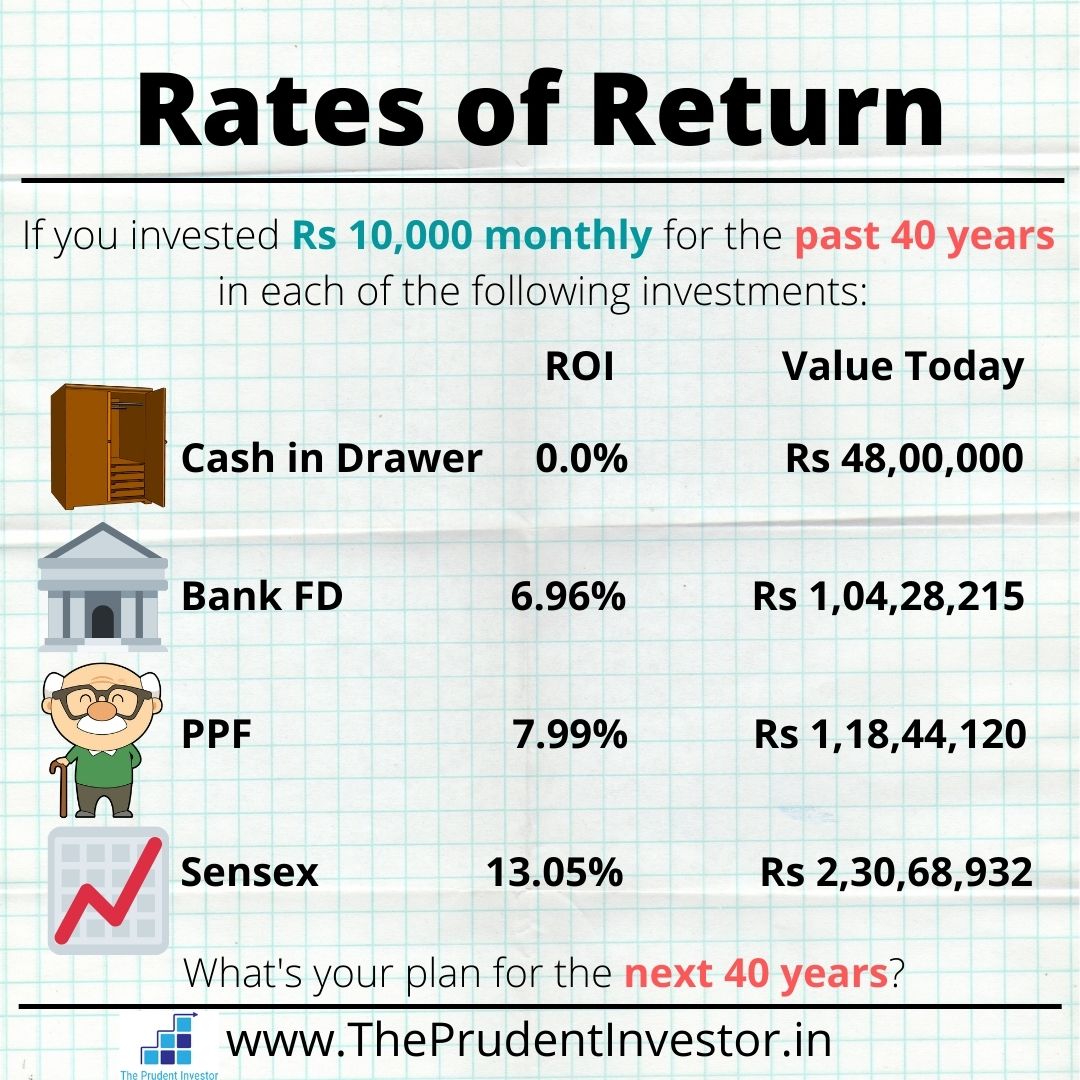

The recent hype around increased interest rates make it sound like good news.

How we all wish… This slight increase just isn’t enough to deliver some real impact.

I’m assuming no one is saving money in their cupboard lockers.

Many salaried employees rely on the tax-efficient PPF to sail through. But its rate of return is only 1 percent higher than FDs.

Investing in equity, however, is one of the best means of wealth creation.

When I refer to the 13.05% returns Sensex has delivered over the past 20 years, the response I get is:

“Too good to be true, and what about inflation?”

No doubt, inflation matters a lot! 1 crore in 20 years will not buy what it can today.

In fact, after deducting for inflation, the returns from other asset classes are woefully low.

Assuming inflation of 6% (the historical average for the past 20 years is 6.39%), your 48 lakh savings in your cupboard locker would be worth only 26.07 lakhs today. Your bank fixed deposit would marginally outpace inflation at 52.93 lakhs. Your PPF would fare slightly better at 59 lakhs. But your Sensex investment, even after deducting 6% inflation, would amount to 1.05 cr.