Very often, during conversations with investors, we recommend setting a target of about 5-10 crore for retirement depending on their lifestyles, financial goals, and current income levels. Many ask “How on earth are we going to achieve that?” Today, we are going to tell you how.

If I give you one paisa every day in October, how much money do you have at the end of the month? You’re right, thirty-one paisa.

Now, what if I give you one paisa on the first day, but two paisa on the second day? Then I double it to four paisa on the third day, and double it again to eight paisa on the fourth day, and so on until the end of the month. Now, how much money will you have?

Please take a moment to answer this question.

Most people guess in the range of 10 to 20 rupees. Sometimes 100 rupees, and occasionally someone will throw out a really big number.

But no matter how big it is, it doesn’t come anywhere close to the answer. The correct answer is 2.1 billion paisa or 2.1 crore rupees. You could buy a nice house at the end of the month!

Small changes compounded for long periods of time are no less than magic. If you have a few decades on hand, you do not need an extraordinary rate of return to deliver phenomenal returns. It’s not intuitive, but it’s so powerful.

“The greatest shortcoming of the human race is our inability to understand the exponential function.”

Physicist Albert Bartlett

And isn’t it the same in investing?

Earning a 12% return in one year is great. Doing it for three years is commendable. Earning 12% per year for 30 years creates something so extraordinary it’s hard to imagine. Time is the investing factor that separates, “Good job,” from “Unbelievable”.

So much focus in investing is on what people can do right now, this year, maybe next year. “What are the best returns I can earn?” seems like such a natural question to ask.

But that’s not where the magic happens.

Once you realise that compounding is where the magic happens, and realize how critical time is to compounding, the most important question to answer as an investor is not, “How can I earn the highest returns?” It’s, “What are the best returns I can sustain for the longest period of time?”

That’s how you maximize wealth.

We are not saying good returns don’t matter. They certainly do. It is just that they matter less than how long your returns can be earned for. “Excellent for a few years” is not nearly as powerful as “pretty good for a long time.”

Benjamin Graham (the father of value investing) was aware of this risk when he said that more money has been lost seeking a little extra return than has been lost to speculating. He warned that it is one of the greatest temptations that new investors face when building a portfolio.

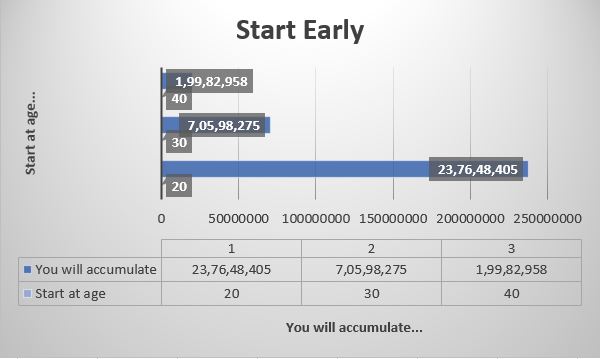

The chart shows how much money you’ll accumulate over time if you invest 20,000 a month starting at different ages. It assumes a 12 percent average annual rate of return.

If you start at age:

- 20: You’ll accumulate 23.8 crore by age 60

- 30: You’ll accumulate 7 crore by age 60

- 40: You’ll accumulate 2 crore by age 60

Just as NASA had to choose from thousands of trajectories for Voyager 1 and 2, you will need to choose from an endless supply of investment advice. The decisions you make today will have compounded effects decades later.

These small decisions are hard to notice in the short run, but impossible to ignore in the long run. A simple example of this is your savings rate. Imagine increasing your savings rate from 5% to 10% (or 15%) of your income. Initially, the benefits of this will be negligible. But over time, the results will be overwhelming.

Many people wrongly assume they should start investing only after they have accumulated a significant amount. Therefore, they delay investing until they are in their mid-forties. Bad idea. When you start investing from an early stage, it doesn’t matter how much you can invest. Even if you invest small amounts of money regularly, you can hope to achieve a sizeable corpus over time.

Remember, investing is a long-term endeavour – you shouldn’t be looking to double your money in 3-5 years. You should be looking to grow your money over time.

The simple fact is that WHEN you start saving outweighs how much you save.

If you are saving for your child’s education, start saving when they are in diapers and not when they are starting their college search.

Benefit of Compounding

You may have heard it said, “No risk, no reward.” Now here is the twist: time can actually decrease your risk while increasing your reward.

Time is the X-factor that can make investments less risky and the best part is it is on your side.

Historical data shows that if you invested in the stock market for a year, your chance of losing money would be 33%. But if you invested for more than 8 years, the possibility of getting negative returns would drop to 0.

How To Use Compound Interest To Your Advantage

Start Early

This is the key takeaway once you grasp the concept of compounding. If you didn’t start investing when you started earning then at least start now.

Be Disciplined

The fantastic returns that are generated are dependent on consistency which only comes from financial discipline. It really helps to automate your investments with SIPs.

Learn Patience

Everyone wants to earn a higher rate of return, although that can be dangerous because higher rates usually entail higher risk. Unless you know what you’re doing, no matter how successful you are along the way, you always want to avoid the possibility of losing more than a budgeted amount of capital. When you understand the time value of money, you’ll see that compounding and patience are the ingredients for wealth.

We’re not trying to convince you of the power of compounding or the need to invest for the long term.” We know you already know that.

Our goal is to remind you how vital long-term thinking is in a world that is dominated by instant gratification. Without even realizing it, we are constantly being bombarded with messages that emphasize living short term:

- Do you need a ride right now? Get an uber.

- Do you need stock advice right now? Switch on CNBC TV 18.

- Do you need social validation right now? Open your social media app of choice.

- Click button. Get loan.

These offers are everywhere, and they are affecting the way we think.

Whether it is your health, your relationships, your career, or anything important to you; remember that Rome wasn’t built in a day.

Savings, Investment and Time are the holy trinities of any wealth creation process. With the aid of these 3 one can create a large enough corpus, and on top of that one does not need to start with a large amount or get a super-sized return. Timely investment of small amounts and moderate returns over a large enough time frame can still give super returns.